Condo Insurance in and around Grants Pass

Looking for excellent condo unitowners insurance in Grants Pass?

Quality coverage for your condo and belongings inside

There’s No Place Like Home

Your condo is your home. When you want to chill out, catch your breath and unwind, that's where you want to be with your favorite people.

Looking for excellent condo unitowners insurance in Grants Pass?

Quality coverage for your condo and belongings inside

Agent Nicole Whitcomb, At Your Service

You want to protect that special place, and we want to help you with State Farm Condo Unitowners Insurance. This can cover unexpected damage to your personal property from a covered peril such as smoke, vehicles or theft. Agent Nicole Whitcomb can help you figure out how much of this awesome coverage you need and create a policy that works for you.

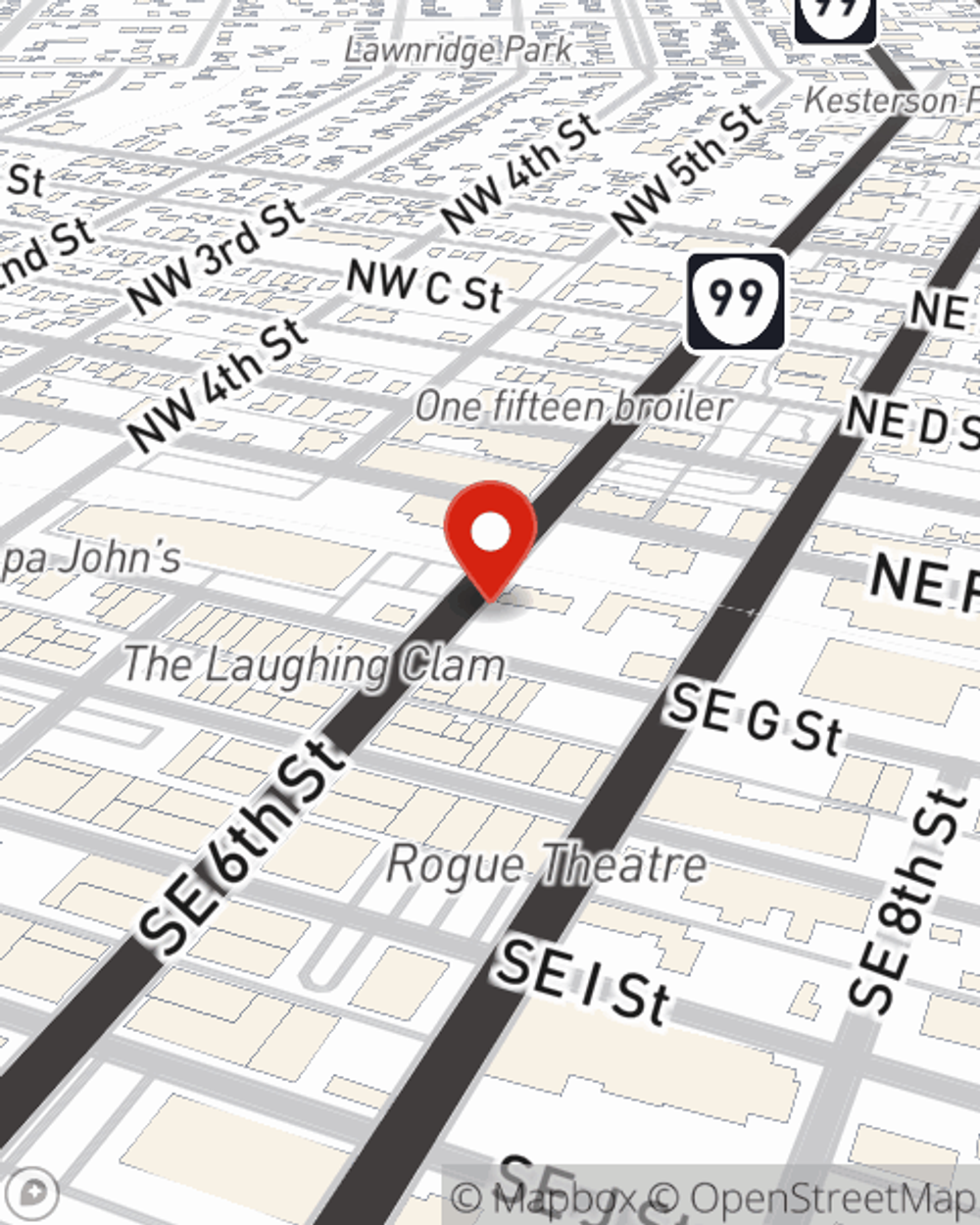

When your Grants Pass, OR, condominium is insured by State Farm, even if life doesn't go right, State Farm can help cover your property! Call or go online today and find out how State Farm agent Nicole Whitcomb can help meet your condo unitowners insurance needs.

Have More Questions About Condo Unitowners Insurance?

Call Nicole at (541) 474-2800 or visit our FAQ page.

Simple Insights®

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

How to get rid of bed bugs

How to get rid of bed bugs

Learn about potential ways to spot bed bugs and what you can do to get rid of them before they spread throughout your home.

Nicole Whitcomb

State Farm® Insurance AgentSimple Insights®

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

How to get rid of bed bugs

How to get rid of bed bugs

Learn about potential ways to spot bed bugs and what you can do to get rid of them before they spread throughout your home.